Who's Who in the Cloud Database Report Top 20

Out with the old, in with the new, as PlanetScale, SingleStore, Yugabyte join the list

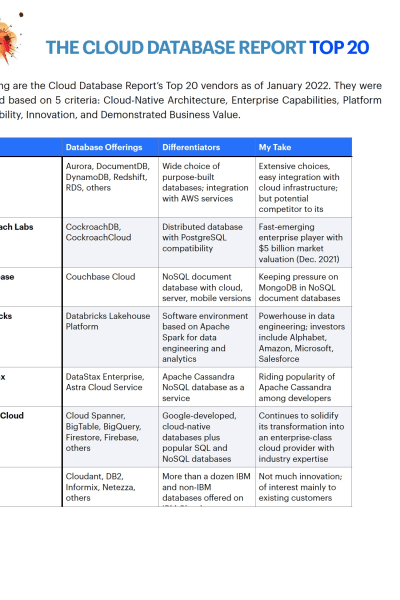

It’s time to provide some added context to the Cloud Database Report’s Top 20, which is based on my analysis of the ever-changing competitive landscape in the database market. These companies range from firmly established industry leaders such as AWS, Google Cloud, Microsoft, and Oracle to startups such as PlanetScale and Yugabyte, which are on the ascent.

This Top 20 list is included in my recently published Cloud Database Report 2022, and it’s an update to Top 20 list that I first introduced in February 2021. There have been a few changes, which I explain below.

The Top 20 is based on 5 criteria: Cloud-native architecture; enterprise capabilities; platform adaptability; innovation; and demonstrated business value.

The downloadable chart provides an alphabetical list of the Top 20; a snapshot of each company’s database offerings and differentiators; and my take on each company’s strengths and/or weaknesses. (Note: Substack has not enabled a PDF preview feature yet.)

Who’s in

New to th…